Agentic Claims Management™

Our expert in-house claims team leverages advanced data and intelligent systems to streamline resolutions, minimize disruptions, and provide businesses with the support they need.

Submit a claim (link opens in new tab)

YOUR COUNTERPART

Our in-house claims experts resolve claims faster, reduce friction, and keep businesses moving forward.

94%

Customer satisfaction for our in-house Agentic Claims Management™ and client support.

<1

Day to acknowledge first claims, ensuring a swift response when it matters most.

50%

Faster close of claims, keeping businesses protected and minimizing disruptions to operations.

Agentic Claims Management™

Smarter claims handling, superior outcomes. We resolve claims faster, minimize business disruptions, and provide insureds with the guidance they need — delivering better outcomes with less friction.

Agentic Claims Management™

Rapid Claims Intake

An intelligent, streamlined process that collects claim details and directs them to the right handler for faster, more efficient review and resolution.

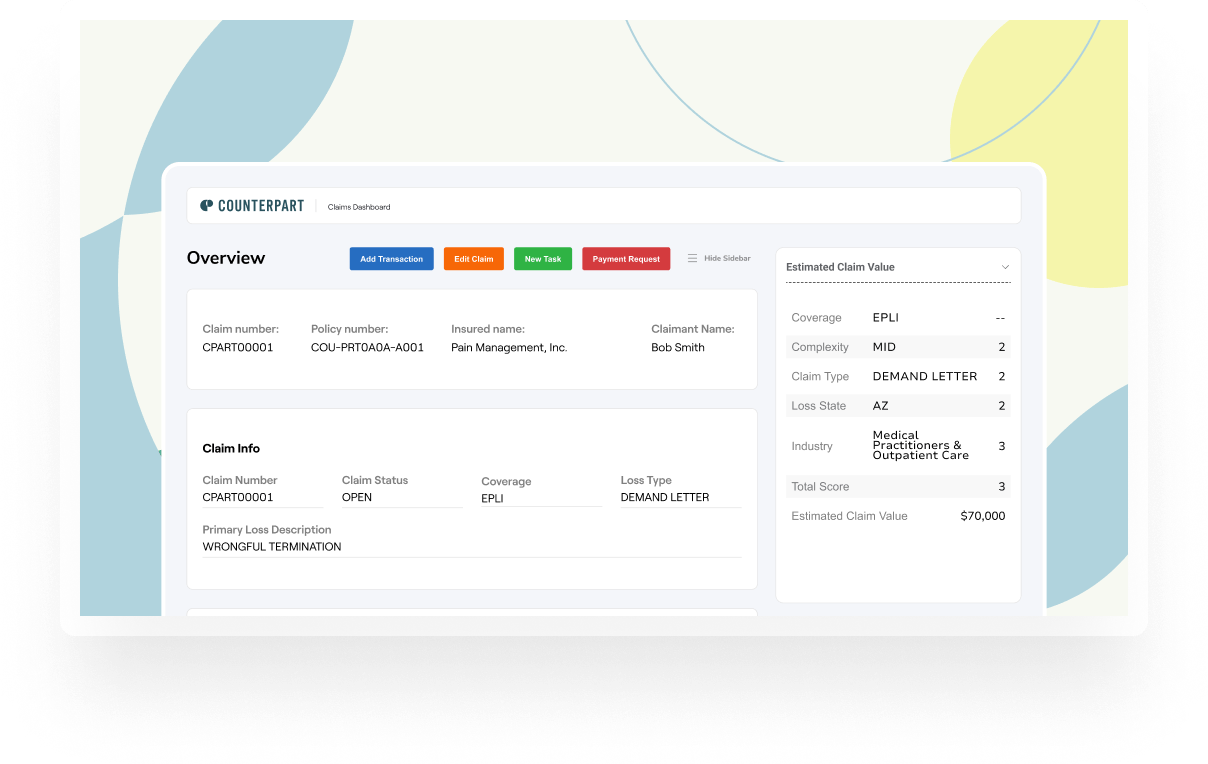

Claims Prediction Model

Proprietary analytics system that anticipates claim outcomes, enabling more strategic and proactive claims management.

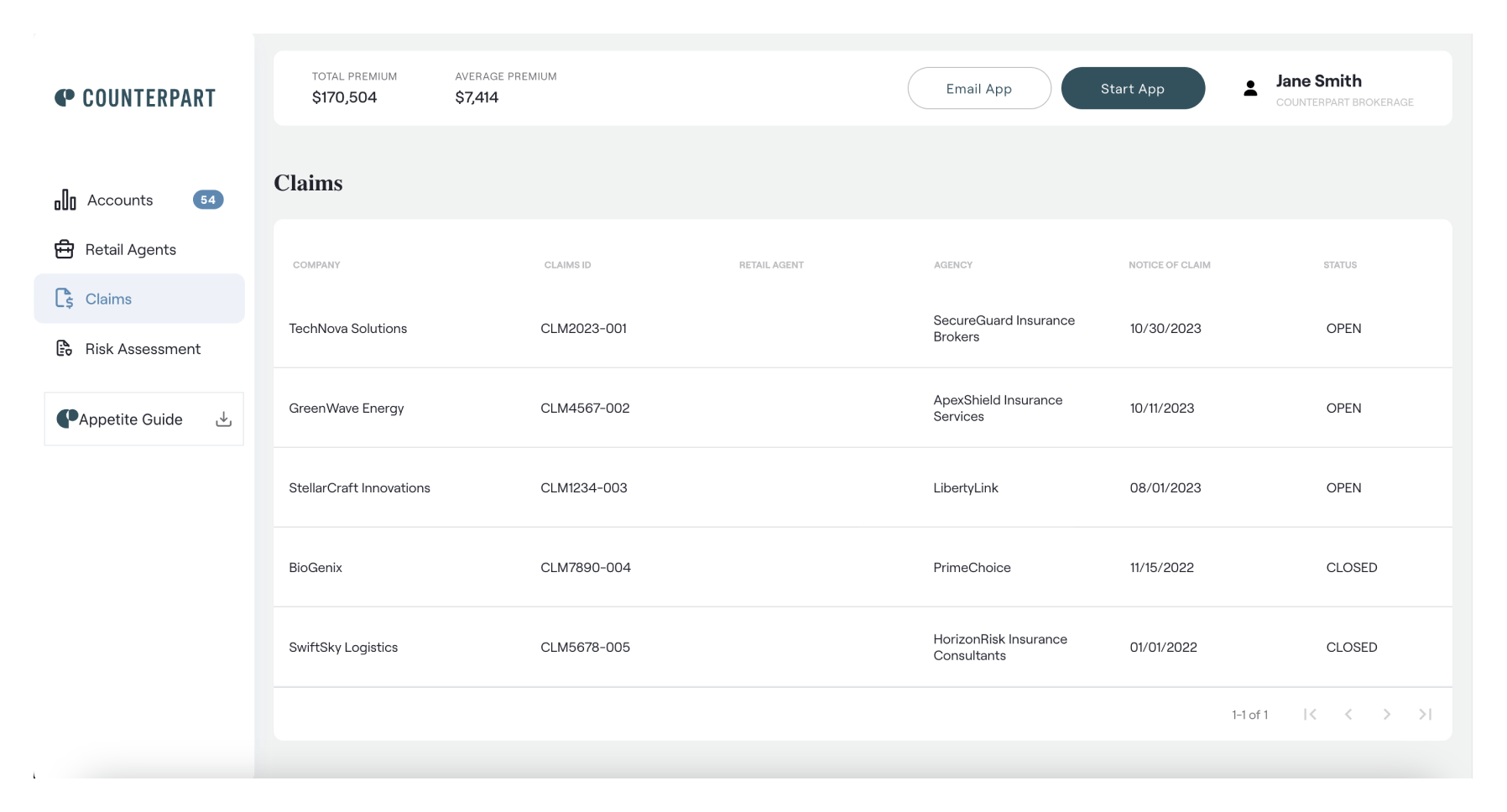

Claims Dashboard

Real-time visibility into insured losses and claim statuses, giving brokers instant access to critical updates within their dashboard.

Defense Counsel Analytics

A data-driven approach to selecting legal representation, ensuring each claim is matched with the attorney best suited to deliver optimal results.

Legal Expense Audits

A structured process for managing litigation costs, ensuring legal spend is optimized through proactive oversight and verification.

With decades of experience, our expert team is ready to quickly resolve your claims.

With decades of experience, our expert team is ready to quickly resolve your claims.

Eric Marler

Head of Claims

Eric Marler

Head of Claims

A licensed attorney, Eric began his career in private practice representing carriers in complex coverage matters before transitioning in-house. Prior to joining Counterpart, he held leadership roles at The Hanover Insurance Group and Great American Insurance Group.

Jaclyn Vogt

Senior Claims Manager

Jaclyn Vogt

Senior Claims Manager

Jaclyn is a seasoned claims manager with 15 years in the industry. Prior to Counterpart, she was a Chief Claims Specialist at RSUI. Jaclyn's extensive claims background and her commitment to excellence help drive fast, efficient outcomes for clients.

Katherine Dowling

Claims Manager

Katherine Dowling

Claims Manager

Katherine is a licensed attorney specializing in professional liability claims. She spent almost a decade at RSUI as a Chief Claims Specialist before coming to Counterpart. Before joining RSUI, she practiced at several law firms, focusing on employment litigation.

Dawn Woodman

Claims Manager

Dawn Woodman

Claims Manager

Dawn is an attorney specializing in employment practices liability (EPL) claims. With over a decade of experience in the insurance industry, Dawn spent the past four years dedicated to handling EPL claims at both Chubb and Axis.

Dan Dubick

Claims Manager

Dan Dubick

Claims Manager

Dan has worked across the insurance claims industry, including medical professional liability with MAG Mutual and Fortress Insurance and automobile liability with State Farm. A licensed attorney and mediator, he has held roles spanning legal practice and claims management.

Nicolette Merlino

Associate Claims Manager

Nicolette Merlino

Associate Claims Manager

Nicolette is an attorney with a law degree from Pace University. Her background includes handling a broad range of management liability claims, most recently at AXIS.

Alexis Keller

Associate Claims Manager

Alexis Keller

Associate Claims Manager

Alexis is a licensed attorney with expertise in professional and management liability. She brings a strong background in litigation, claims management, and risk analysis, drawing on experience as both a prosecutor and insurance claims specialist.

Our claims process

Our claims process

Submit your claim

Same-day acknowledgement

Meet your claims manager

Receive coverage verification

Resolve your claim

Claims Examples

Get Claims Support

Expert claims managers and leading defense attorneys ensure that we achieve the best outcome as quickly as possible, so you can get back to doing what matters most — running your business.