Agentic Underwriting™

Counterpart's dedicated underwriters leverage the most advanced management and professional liability rating system to deliver efficient, transparent coverage.

Get a quote (link opens in new tab)

YOUR COUNTERPART

More efficient and adaptive underwriting provided by insurance experts leveraging cutting-edge technology and AI-enhanced workflows.

25K+

Policies issued since Counterpart’s inception, proving broad market expertise.

A

Rating by AM Best for all four capacity partners for management and professional liability products.*

80%+

Average account retention rate for renewal submissions.

Agentic Underwriting™

Intelligent underwriting, unparalleled service. Our AI-driven insights empower brokers to deliver precise coverage, faster decisions, and a seamless experience for their clients.

Agentic Underwriting™

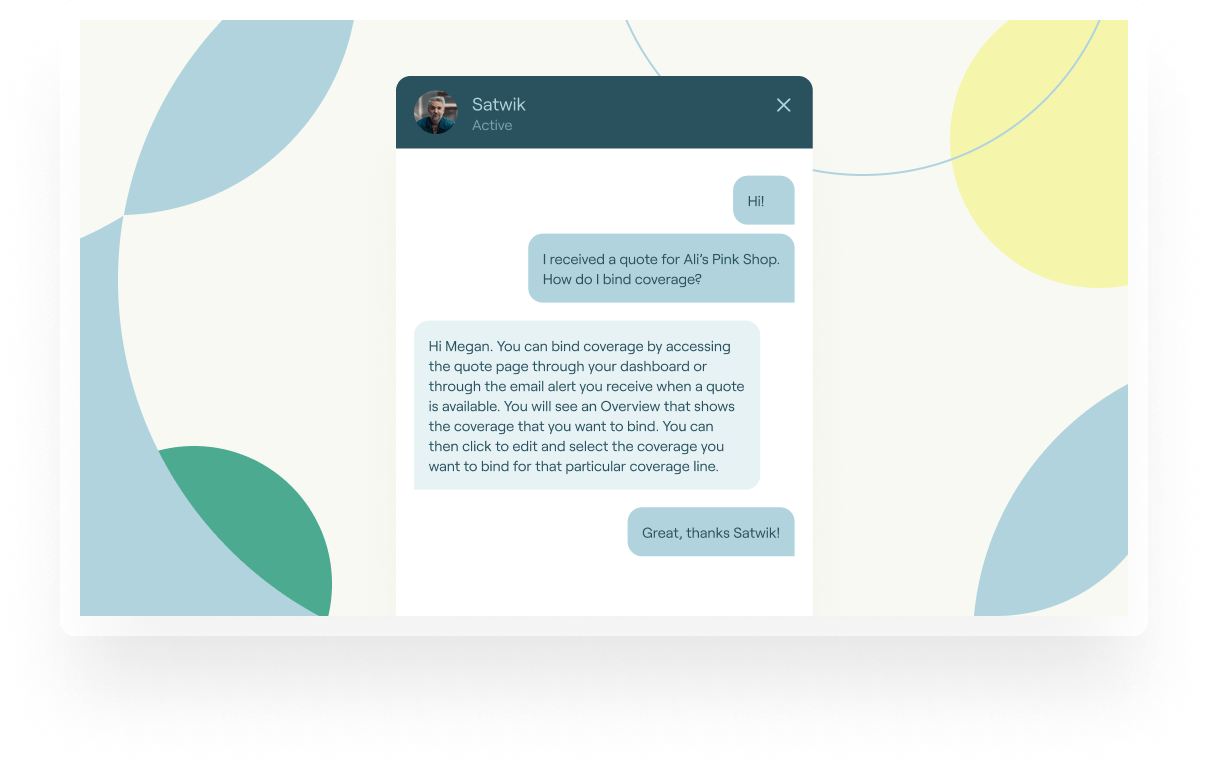

Dedicated Underwriters

Human underwriters leverage their broad authority to collaborate directly with brokers — reducing friction and delivering more efficient decisions.

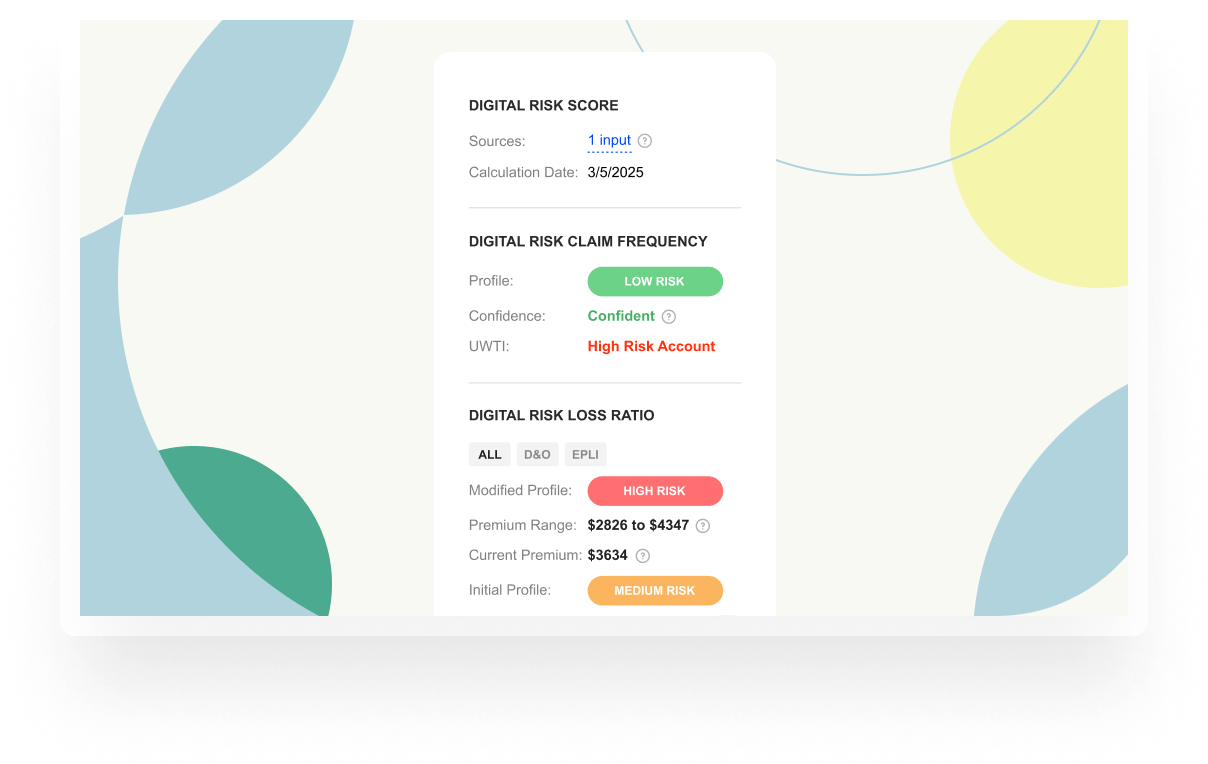

Digital Risk Score

Our proprietary Digital Risk Score uses advanced data analytics to deliver faster, more competitive pricing and terms — giving brokers an edge in the market.

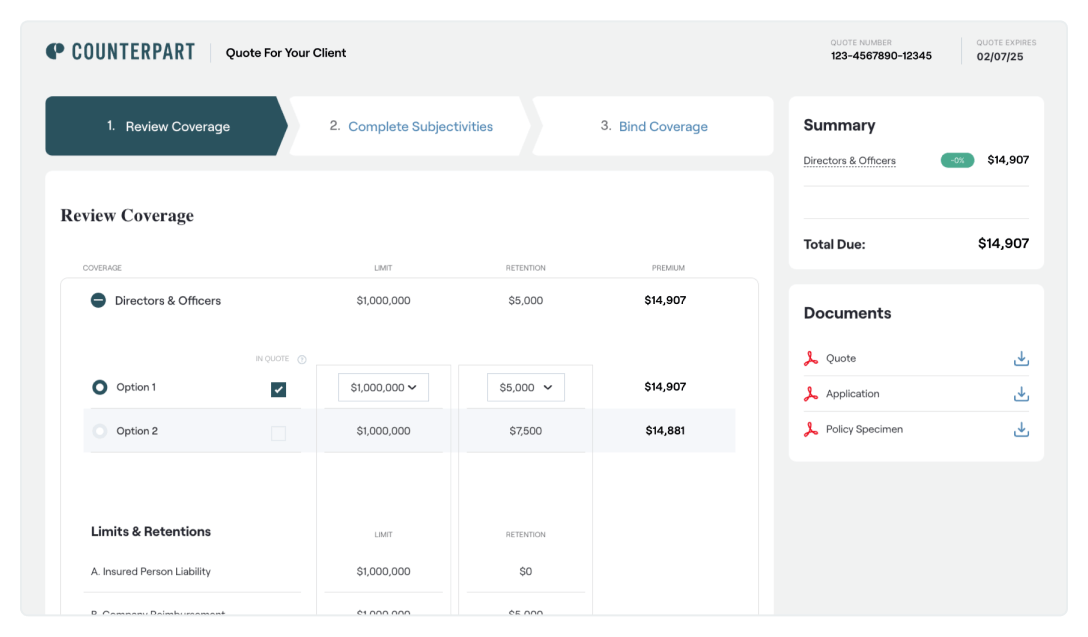

Digital Underwriting Platform

Within our digital platform, brokers can instantly adjust coverage options in the dashboard, tailoring policies to fit their clients’ needs with ease.

Instant Quote

Get quotes in minutes, limiting back-and-forth and giving brokers more time to focus on advising and supporting their clients.

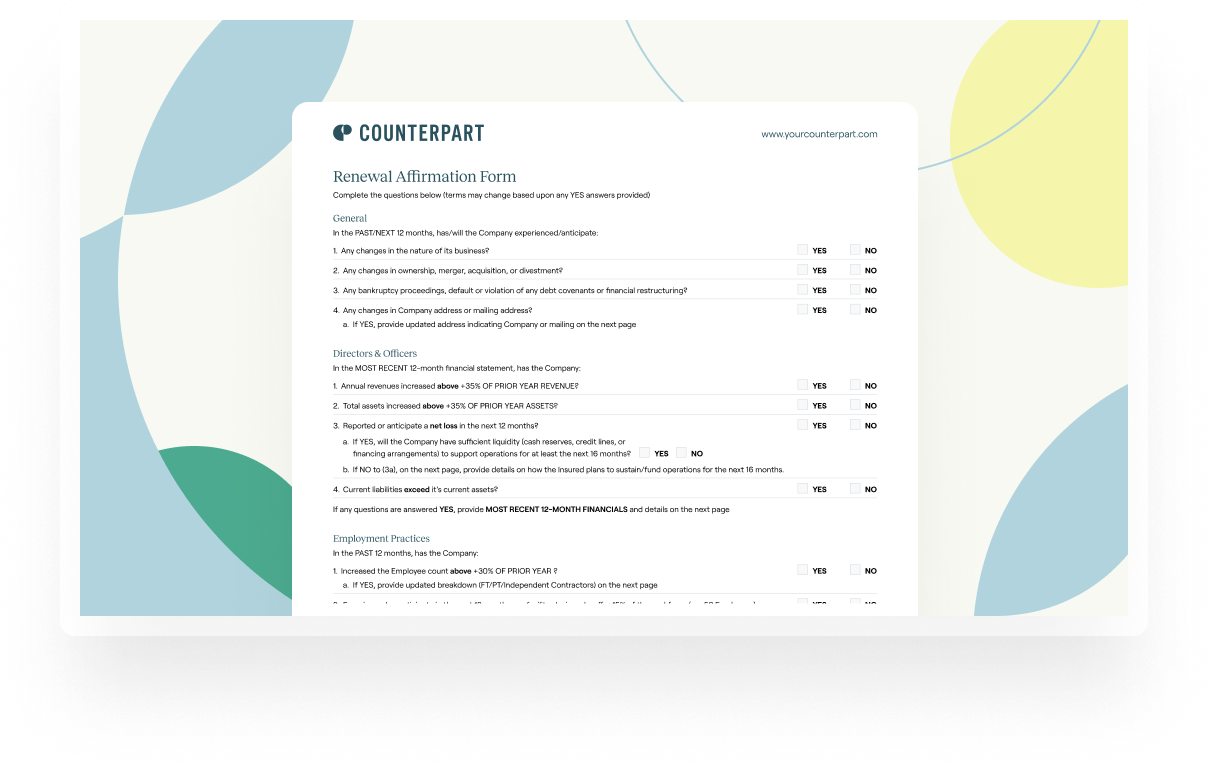

Auto Renewal

We simplified renewals to just a few clicks, reducing administrative work so brokers and clients can stay focused on growth.

Our Agentic Underwriting™ team combines deep industry expertise with AI-driven intelligence to craft tailored solutions for brokers and businesses alike.

Our Agentic Underwriting™ team combines deep industry expertise with AI-driven intelligence to craft tailored solutions for brokers and businesses alike.

Brad Bahler

Territory Manager, Central

Brad Bahler

Territory Manager, Central

Brad has over a decade of experience in management and professional liability underwriting. Brad is known for his deep understanding of coverage, outstanding submission response times, and boundless enthusiasm for the space.

Jake O'Donnell

Territory Manager, East

Jake O'Donnell

Territory Manager, East

Jake started his insurance career underwriting D&O, EPL, Fiduciary, and Crime coverages for private and not-for-profit companies. Jake holds a master's from Temple University and a bachelor's from the University of Miami. He received his CPCU designation in 2021.

Cameron Tognetti

Territory Manager, West

Cameron Tognetti

Territory Manager, West

Cameron started his insurance career underwriting at Chubb before moving into a business development role at Gallagher. He later joined Tokio Marine HCC, where he advanced to Lead Underwriter for Cyber and Tech E&O. Cameron has a bachelor’s degree in Economics.

Get Coverage

Our technology-driven approach, paired with trusted insurance experts, ensures faster decisions with better client outcomes.